THE MARKET

We enjoyed strong performance from 2009 until 2017. By late 2017 most of the stocks fund managers would want to own were overpriced relative to the companies’ earnings and yet the market continued to rise to what many consider unreasonable levels. This caused a dilemma for fund managers and individual investors as to whether to be patient and hold cash or buy high and risk riding the stocks down in the correction that will inevitably take place at some point.

Between high stock prices, ongoing political turmoil in the US and a sluggish Canadian Economy we are reluctant to remain heavily weighted in North America and feel global markets are where there are better opportunities to buy quality stocks at prices that make sense. Dynamic’s Global Dividend Fund has proved a great addition to our holdings.

*To reference fund, must include table with YTD 1 yr 3yr 5 yr 10yr and incep returns* Managed by David Fingold, this is a medium risk fund with a solid performance history that has outperformed its peers. We continue to perpetually monitor the accounts and assess our fund holdings. It is impossible to predict or time the market.

When the correction comes please do not panic as it is likely to be short-lived, as bear markets have always been historically, and on the other side we will see gains again. Funds like NorthStar are prepared with defensive measures in place. NorthStar’s fund managers are holding cash behind the scenes and awaiting the buying opportunities that are likely to present themselves in the coming months.

WHAT ARE ETF’s?

For those who don’t know, a mutual fund is an open-ended formal trust whereby investors can pool their money together to be actively managed by a professional portfolio manager whose full-time job is following the market and picking stocks.

Exchange traded funds (ETF’s) are closed-ended trusts where there are a limited number of the trust shares, and they can be sold by the fund company, intermediaries as well as traded between investor’s.

The total cost of running one versus the other is similar, however when trading an ETF the cost is usually paid by the investor in the form of transactional fees, whereas in a mutual fund it’s burdened by the fund company and added to the MER (management expense ratio.) Another key difference is that usually, mutual funds are actively managed, and ETF’s are passively managed. Active management is where a fund has a portfolio management team who pick stocks at their discretion.

Passive management is where a fund follows a set of rules and holds stocks accordingly (for example the S&P 500 is simply the largest 500 companies in America in terms of market cap.) Now days however, you can get passive management in a mutual fund wrapper and active management in an ETF wrapper. They’re interchangeable. (note: the MER on actively managed funds can be anywhere from 0.2% to 1% more expensive, for the benefit of having a portfolio manager in the equation.)

VANGUARD

Vanguard is the second largest manager of wealth in the world with global assets under management of 5.1 billion. Vanguard has gained a lot of traction over the last decade for having low cost investment solutions and for being pioneers in indexing (passive management.) Until recently, their Canadian arm has dealt exclusively in ETF’s.

Recently however, they launched 4 mutual funds in Canada which are actively managed funds and have very competitive costs. They structured them such that the MER changes depending on performance.

If the fund performs very well (relative to its benchmark) then the MER can go as high as 0.5% which is still half of the industry standard. If the fund does poorly relative to its benchmark, then the MER can go as low as 0.3%.

This structure is very consumer friendly and competitive, we hope as well that this push by Vanguard encourages other fund companies to be more competitive with their fees. We also look forward to gaining access to ETF’s in the future at which time we should be able to use Vanguards index funds in tandem with the actively managed funds we know and love today.

FIDELITY FACTOR-BASED

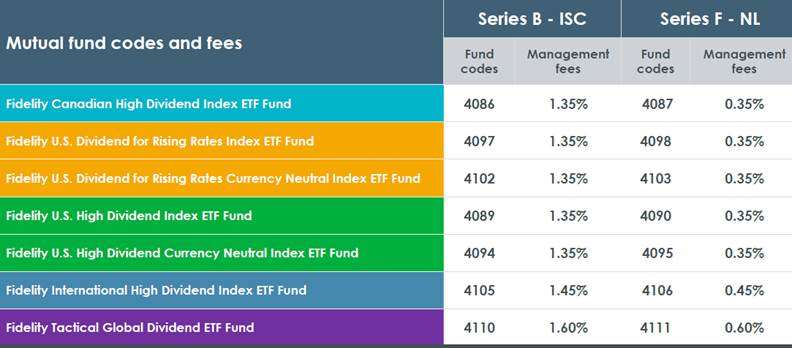

Fidelity is launching some factor-based ETF’s & mutual funds that we’re excited to track, but hesitant to implement right away. The premise of these new funds is to have an investment solution which has the cost efficiency of a passive fund, and the nature of an actively managed fund.

By basing decisions off factors rather than discretionary trading, they can avoid paying a portfolio manager to do those trades and the associated research. Instead, they allow computers to track and own stocks with certain tolerances like max price:earnings ratio of X, or debt service levels of Y. We are seeing a big push for reduced fees, Fidelity has done a great job in making these new factor-based funds highly competitive in that regard with MER’s from .35% to 0.6%.

QUOTES

You cannot delegate your responsibility to understand the world around you

If you fulfill your obligations everyday you don’t need to worry about the future

DISCLAIMER: This newsletter contains general information only and is intended for informational and educational purposes provided to the clients of Anne Marie Dryden & Hans Bischoff. While information contained in this newsletter is believed to be reliable and accurate at the time of printing, Anne Marie Dryden & Hans Bischoff do not guarantee, represent or warrant that the information contained in this newsletter is accurate, complete, reliable, verified or error-free. This newsletter should not be taken or relied upon as providing legal, accounting or tax advice. You should obtain your own personal and independent professional advice, from your lawyer and/or accountant, to take into account your particular circumstances. Commissions, trailing commissions, management fees and expenses all may be associated with ETF & mutual fund investments. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any security holder that would have reduced returns. ETF’s & Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. Please read the prospectus before investing. The views expressed in this message are not necessarily the views of Investia Financial. Exchange traded funds, mutual funds and exempt market products are offered through Investia Financial Services Inc.