Back to Business

We are getting back to regular business and are once again encouraging face to face meetings for those who are comfortable with them. To protect ourselves and our clients we will be disinfecting the office surfaces between meetings, keeping a safe distance, and wearing masks by request.

Meeting with your financial advisor may feel like something you can easily put off, but we strongly encourage some form of meeting at least once or twice per year.

It can be a simple phone call, webcam meeting, or face to face. Your financial wellbeing is important, and it is important for you to be aware of what is going on and what is affecting your wealth. Together we can make pragmatic and informed decisions that best suit your financial plan and lead to the best possible outcome.

Volatility & Uncertainty

The VIX is a tool used to measure volatility in American stocks. It does this based on S&P500 index options. If a lot of people have options on the S&P 500, that signals that there is a lot of skepticism in the markets.

In 2008, the VIX rose about 380% and took about 1.5 years to settle back to 0%. In COVID- 19 the VIX peaked around 500% (albeit from a lower starting point) and is now sitting at around +160% since mid-February.

What this means is that there is still a decent amount of skepticism in the markets today, as compared to 5 months ago. It also indicates to us that market volatility will not suddenly disappear, but it does seem to be lowering faster than 2008. Volatility and uncertainty go hand in hand, and until the future becomes more certain, volatility will likely remain high.

As an investor however, by the time things are certain it is too late to invest in and profit from the recovery. That is why you hear us say ‘stay the course’ during recessions, because that is an investor’s best chance at a positive outcome. However, that is not to say asset allocation decisions shouldn’t be made through bear markets.

Figure 1

Source: Google (search VIX Chart)

Inflation

Jeremy Siegel, professor of Finance at the University of Pennsylvania was featured on CNBC recently.

Siegel claims that the 40-year bull market in bonds (specifically investment grade bonds) is doomed.

Siegel looks to WW2 for answers, as we did a few months ago. In 1946 inflation was 1.7%, then in 1947 it shot up to 19%, subsequently by 1949 it was back down to 1.26%. I did not miss a decimal point, inflation went up 11x in one year, then slammed back down to ‘normal’ within about 3-4 years after the war. There are many economic similarities that can be drawn between a time of pandemic and a time of war.

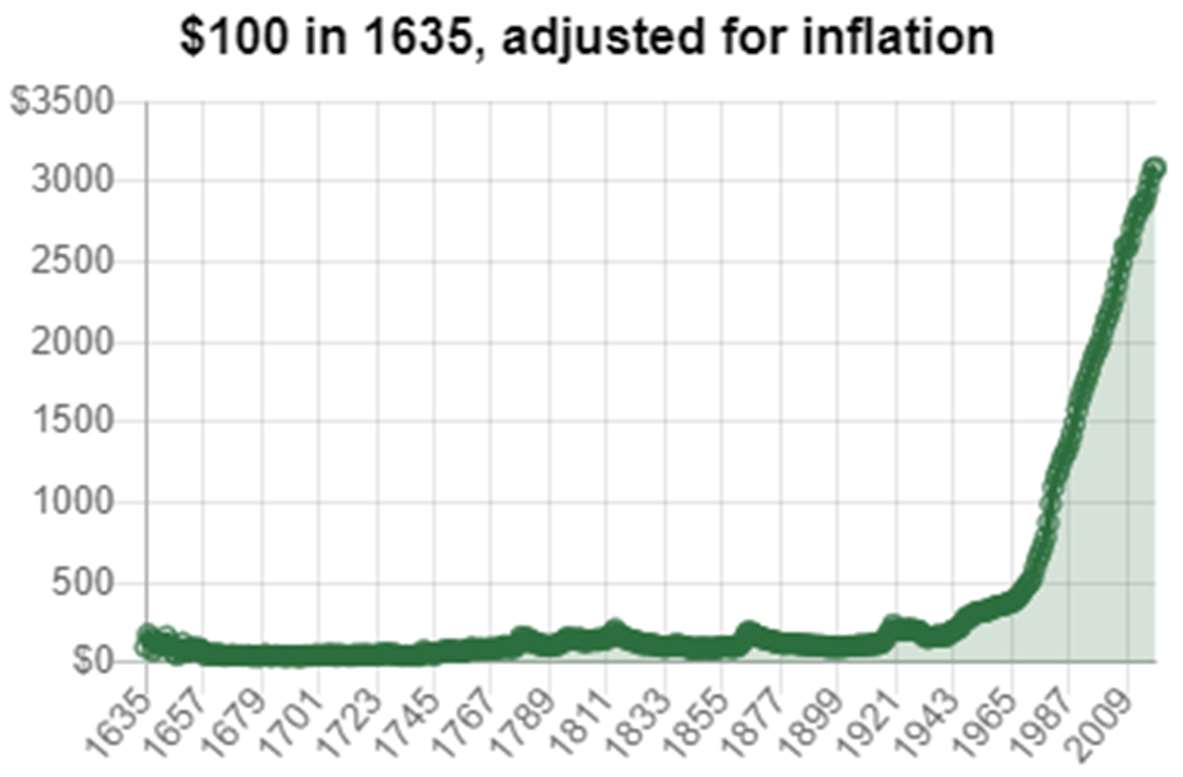

Figure 2

Source: in2013dollars.com

One key difference that Siegel pointed out was the federal reserves’ response to each event. During WW2, the fed was issuing war bonds begging people to contribute to the cause at a rate of interest lower than the 10yr treasury yield.

Conversely during COVID, the fed has been sending people money, ‘buying’ bonds to keep the market afloat, and spending the capital needed to solve the COVID-19 problems. Large difference! We think this largely boils down to Nixon’s removal of the ‘gold standard’ which many people forget did not happen until 1971.

Pre Nixon, if the fed printed money they needed to hold gold as well to back it up, lest they get over levered and risk the currency failing. Richard Nixon removed the gold standard allowing the US total autonomy over its currency. See figure 2 and notice the sharp and sustained increase in inflation from around 1971 forward.

Some clients hold gold in their mutual fund portfolio to hedge this inflation risk, others are content to just stay the course. We already have very little money in investment grade debt and GIC’s, for those assets we believe it will be an uphill battle for a few years.

QUOTES

We don’t have to be smarter than the rest. We have to be more disciplined than the rest.

Money is only a tool. It will take you wherever you wish, but it will not replace you as the driver.

Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas.

DISCLAIMER: This newsletter contains general information only and is intended for informational and educational purposes provided to the clients of Anne Marie Dryden & Hans Bischoff. While information contained in this newsletter is believed to be reliable and accurate at the time of printing, Anne Marie Dryden & Hans Bischoff do not guarantee, represent or warrant that the information contained in this newsletter is accurate, complete, reliable, verified or error-free. This newsletter should not be taken or relied upon as providing legal, accounting or tax advice. You should obtain your own personal and independent professional advice, from your lawyer and/or accountant, to take into account your particular circumstances. Commissions, trailing commissions, management fees and expenses all may be associated with ETF & mutual fund investments. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any security holder that would have reduced returns. ETF’s & Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. Please read the prospectus before investing. The views expressed in this message are not necessarily the views of Investia Financial. Exchange traded funds, mutual funds and exempt market products are offered through Investia Financial Services Inc.