2020 IN SUMMARY

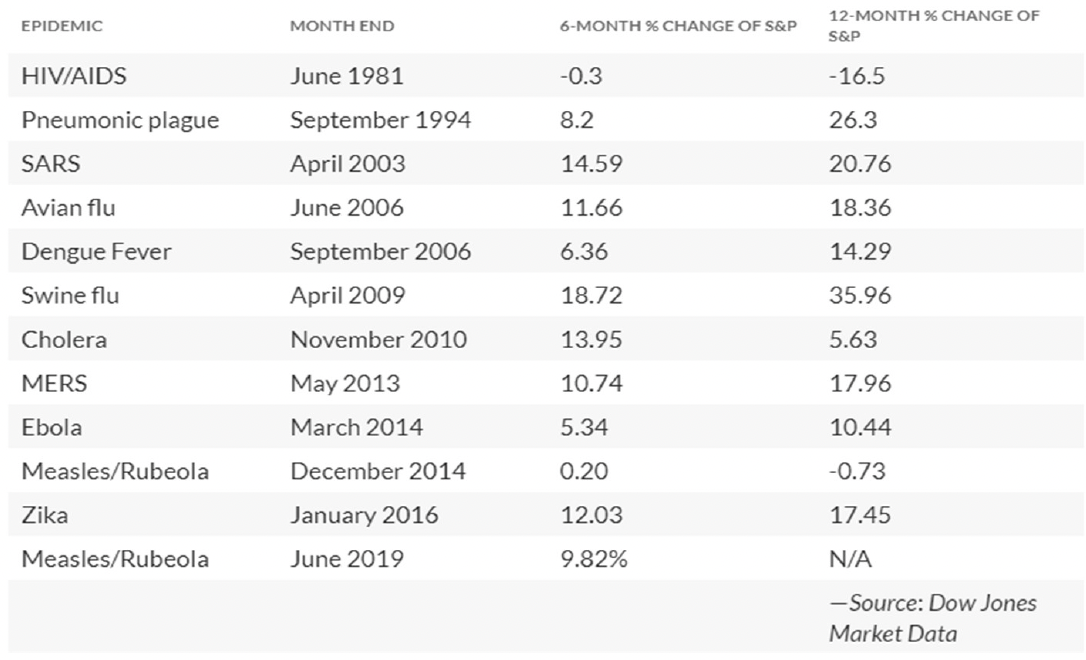

2020 was a heck of a year, I will make this quick because I am sure many of you are keen to forget it ever happened. We sent out our quarterly newsletter March 1st with the below chart showing the effects that past epidemics have had on markets. At that time people, including us, were only just beginning to grasp the potential scope of this current pandemic. In Q1 peak to trough the S&P500 fell -33.92%. Then, in the subsequent 5 months, the S&P500 was back to its’ February highs. To put it plainly, the clients who took our advice, either directly or implicitly, have faired well in these times.

Election Results & Inflation

The state of American politics often has a toll on Canadians, sometimes the influence feels greater than even our own politics. It was with no surprise really that Biden won the 2020 election both with popular vote and with electoral college seats. We say this not from bias or preference but from the fact that the stock market had priced in a reasonably confident Biden victory in the weeks leading up to the election.

Contrary to popular belief the stock market actually does better on average under democratic leadership than it does under republican leadership. There are a few reasons for this.

Mainly, democrats are elected more frequently when the country is in a state of recovery. Democrats are also more willing to spend money and give support whereas republicans tend to be more fiscally conservative.

Overall from an investor perspective I think there is reasonable cause for optimism. I still suspect the extent of this fiscal spending will cause a spike in inflation but am less confident that it will be accurately reported by the CPI index (cost of living index.) Home expenses and cost of food should be 2 cornerstones for a cost-of-living index in my opinion, both have gone up considerably and yet no inflation is reported in the CPI. Convenient, as the CPI is the tool with which pension increases are measured.

New name, new office, & some new faces

2020 was an extremely productive, albeit difficult year for us. It was difficult because this is an intimate business where we like to see the white of clients’ eyes as they tell us about their goals and fears, and the emotion in their face when they tell us about their personal achievements and losses. It was productive because performance has been strong, we have found a new partner in Fijay Manhas in Duncan who we will be working with closely for years to come. We have renamed ourselves ‘BPF Wealth,’ paying homage to our roots while better communicating our main business focus in our name alone.

We have overhauled our website and strongly encourage everyone to check it out. Steff Hunter at Digital Yolk Media + Web, did the design for us and she did an outstanding job.

Kieran Johnson also joined our office; he is running his own practice in the Nanaimo office.

All together we are very happy with the years’ progress and are looking forward to seeing everyone face to face more regularly once again.

This additional office will not impede on our availability to existing clients, it’s a lower volume office and should not take us away from Nanaimo very much plus Fijay is still there to help us run it.

Note: In switching our domain to BPFWealth.ca, we experienced intermittent service loss to our e-mail. If you e-mailed us between Dec 20th and Jan 3rd and did not receive a reply please call us to confirm your request/inquiry.

QUOTES

Democracy is the worst form of government that there is… Except for all the other ones.

Unlimited power in the hands of limited people always leads to cruelty.

DISCLAIMER: This newsletter contains general information only and is intended for informational and educational purposes provided to the clients of Anne Marie Dryden & Hans Bischoff. While information contained in this newsletter is believed to be reliable and accurate at the time of printing, Anne Marie Dryden & Hans Bischoff do not guarantee, represent or warrant that the information contained in this newsletter is accurate, complete, reliable, verified or error-free. This newsletter should not be taken or relied upon as providing legal, accounting or tax advice. You should obtain your own personal and independent professional advice, from your lawyer and/or accountant, to take into account your particular circumstances. Commissions, trailing commissions, management fees and expenses all may be associated with ETF & mutual fund investments. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any security holder that would have reduced returns. ETF’s & Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. Please read the prospectus before investing. The views expressed in this message are not necessarily the views of Investia Financial. Exchange traded funds, mutual funds and exempt market products are offered through Investia Financial Services Inc.