THANK YOU

A special thank you to our clients for your patience through this last RRSP season, between one thing and another this was the busiest RRSP season of my career by far. The COVID-19 pandemic has allowed people to expand their savings rates which is great but also many people were also caught off guard when the CERB was included on their taxes with no deductions against that benefit.

BITCOIN ETF (BTC)

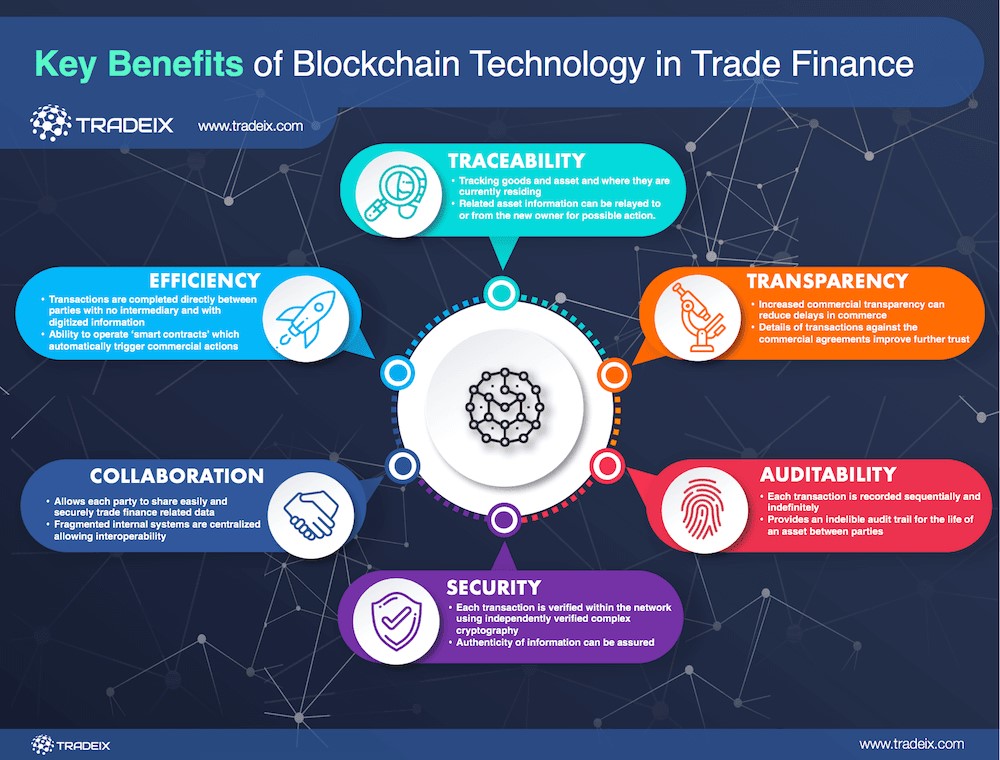

BTC is an ETF that tracks bitcoin. Bitcoin is 1 of many available cryptocurrencies. A cryptocurrency is defined most importantly by its use of ‘blockchain.’ Blockchain is the underlying technology which makes the cryptocurrencies valuable. Blockchain allows for all transactions to be completely transparent but for the transactors to be completely anonymous. Anyone can see any transaction in the blockchain, but they cannot see who the transactions are between. Because all transactions are public record and stored on tens of thousands of computers around the world it is also impossible to ‘crack’ bitcoin. To do this, you would need a computer with roughly 28x more computing power than Google’s current most powerful quantum computer.

The last thing blockchain technology brings is the potential for extremely cheap and efficient transactions. Bitcoin has done a poor job of displaying this as Coinbase transaction fees range as high as 6-10%.

So what is Bitcoin good for? Similar to gold, so far it seems the best case for bitcoin is as a store of value.Bitcoin in the context of cryptocurrencies is already an archaic technology.

If a time comes when we are using a cryptocurrency to buy our groceries it will probably be a new crypto that has not even been created yet, and one that is controlled by government just as $CAD and $USD are now. Owning bitcoin is the definition of a speculative investment. Even if we had the ability to hold bitcoin in our portfolios, we would not advise it.

Bitcoin is an asset that could very feasibly drop to 0, but it could also keep going up. Bitcoins market cap is only 1.1 trillion as compared to gold’s market cap of 10 trillion, so if investors value its ability to store value as well as gold, then it could take from gold’s market cap as an example. The complete uncertainty is what makes it speculative, thus more like a gamble rather than an investment.

NOMINEE ACCOUNTS

For those who are not already enrolled in our nominee program… At FundEX, we have the option to use what are known as ‘nominee’ accounts. This as opposed to the traditional ‘client-name’ accounts are useful for 6 main reasons.

- They give us ‘limited trading authority’ which allows us to take instructions for most requests over the phone or by e-mail.

- Broadened investment shelf, often improving performance.

- You can contribute to your accounts via online banking.

- Consolidation of T-slips for RRIFs, LIFs etc so you just get one per account type.

- Fee-based program, allows for the greatest transparency, reduced MERs and an even broader investment shelf.

- They’re easier for us to manage which allows us to spend more time on things like financial planning, retirement planning, asset allocation and continuing education so that we may remain at the head of our field. This is an option available to all investment clients except for a few account types like US$ accounts and RESPs.

If you are not already enrolled and would like to find out more, please call us to make an appointment.

NOTE: These statements represent April 1st 2020 to March 31st 2021 returns. The COVID market bottom was March 23rd 2020. This may cause some clients rates of return to look inflated relative to their longer-term average.

QUOTES

If you don’t want to work, then that becomes your job.

The best way to teach your kids about taxes is to eat 30% of their ice cream.

All the heiresses are beautiful.

DISCLAIMER: This newsletter contains general information only and is intended for informational and educational purposes provided to the clients of Anne Marie Dryden & Hans Bischoff. While information contained in this newsletter is believed to be reliable and accurate at the time of printing, Anne Marie Dryden & Hans Bischoff do not guarantee, represent or warrant that the information contained in this newsletter is accurate, complete, reliable, verified or error-free. This newsletter should not be taken or relied upon as providing legal, accounting or tax advice. You should obtain your own personal and independent professional advice, from your lawyer and/or accountant, to take into account your particular circumstances. Commissions, trailing commissions, management fees and expenses all may be associated with ETF & mutual fund investments. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any security holder that would have reduced returns. ETF’s & Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. Please read the prospectus before investing. The views expressed in this message are not necessarily the views of Investia Financial. Exchange traded funds, mutual funds and exempt market products are offered through Investia Financial Services Inc.