THE SEPTEMBER EFFECT

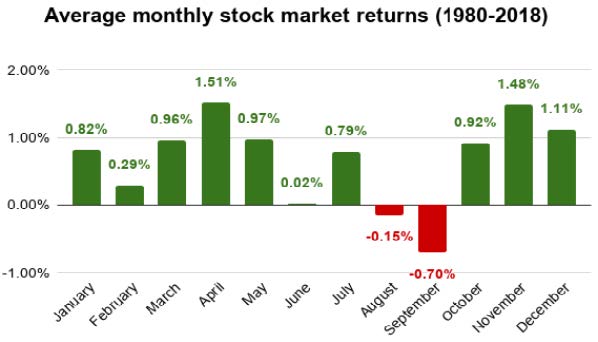

Historically, September has been the worst month for global markets. Since 1950, the DOW has averaged -0.8% and the S&P500 has averaged -0.5% in September. This phenomenon has been dubbed ‘September Effect.’ It is a market anomaly, and is not related to any particular or tangible event/occurrence.

The September Effect is not ‘investable,’ we already know that time in the market beats timing the market.

It’s generally understood that the causes may include seasonal behavior change for individual investors, post-summer expenses, and tax-loss harvesting.

BANK OF CANADA

The Bank of Canada (BOC) BOC is Canada’s Central bank. It is a crown corporation which means it’s owned by the government ergo the public. The BOC is essentially responsible for maintaining the public’s confidence in its fiat currency, the Canadian dollar, by providing low-stable inflation.

More specifically, they control the overnight interest rate, printing of money and quantitative easing. The overnight interest rate is the rate Canadian Banks must pay each other for borrowing. There is a trickledown effect from the overnight rate to the rates retail investors/borrowers pay or are paid for their cash/credit, this is reflected in the Canadian banks ‘Prime Rates.’

Currently, the BOC’s overnight rate is just 0.25%, while Canadian banks prime rates are 2.45%. Over the last 10 years, bank prime rates have stayed around 2 to 2.25% above the overnight rate.

Dropping interest rates is often the first reaction when the BOC is faced with a tragedy like the Great Financial Crisis or the Corona Virus Pandemic.

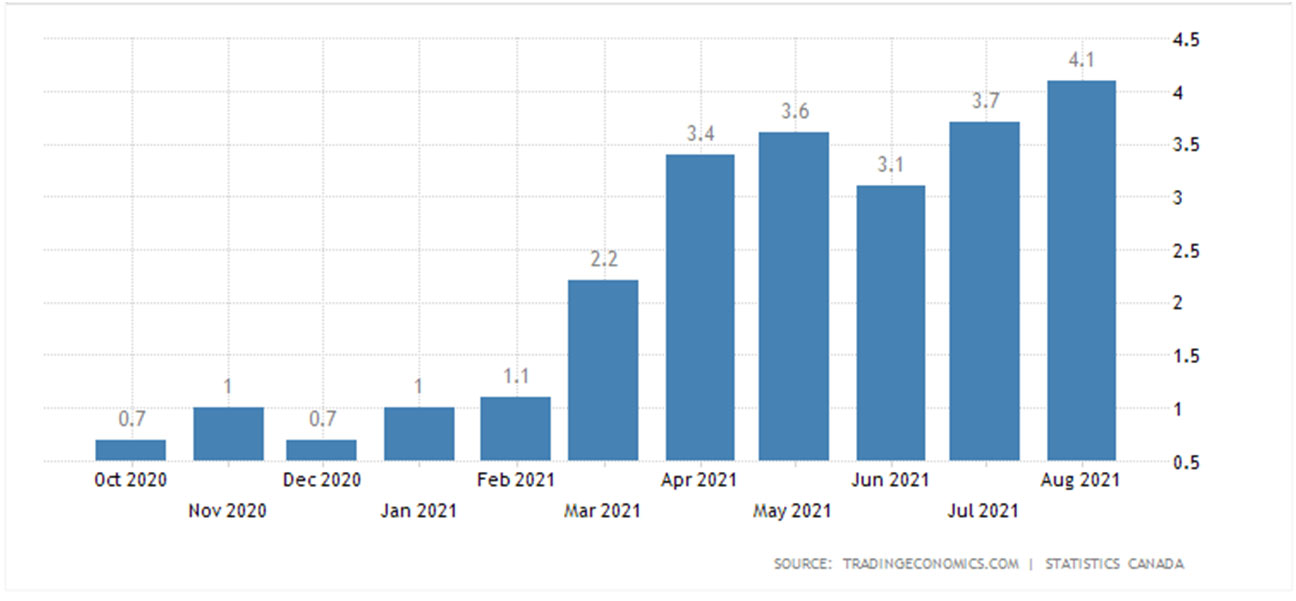

To drop rates however, you need to have somewhere to drop them to. 0.25% is already on the floor, the BOC will be feeling pressure to increase rates especially now that inflation is getting questionable (4.1% annualized in August,) as forewarned in our January newsletter.

THE US DEBT CEILING

We are expecting the recent market volatility to continue through October, or at least until the debt ceiling issue is resolved. The debt ceiling topic comes up every few years and is heavily politicized. We don’t expect any issues to come from it. Of course, if the US government shuts down or defaults that would be horrendous for markets and the US economy, but we really don’t see that as likely. It takes a “super majority” of votes to increase the debt ceiling, but even if the democrats and Republicans can’t settle, there are a few other means by which Biden could circumvent Government closure or default. He could simply blow through it, while technically illegal it’s entirely possible. He could mint a ‘trillion dollars’ platinum coin to adjust the balance sheet of the Federal reserve.

OUR OFFICE

We’ve decided to forego the statement notes this quarter on account of being abnormally busy. The fall is always busier than usual, possibly for some of the same reasons as mentioned in the ‘September Effect’ segment. We believe it’s been exacerbated by the softened COVID restrictions and by everyone (who chose to get it,) having the COVID vaccine and now feeling comfortable to come in again, which we love!

As such, if you have any questions at all, please feel very welcome to reach out. We’d love to hear from you. We will once again be donating in lieu of Christmas cards this year. Please let us know if you have a charity that is near to your heart, and we will add it to our list!QUOTES

Never test the depth of a river with both feet.

Finance that only talks to itself & deals with each other becomes socially useless.

If you cannot understand why someone did something, look at the consequences and infer the motivation.

DISCLAIMER: This newsletter contains general information only and is intended for informational and educational purposes provided to the clients of Anne Marie Dryden & Hans Bischoff. While information contained in this newsletter is believed to be reliable and accurate at the time of printing, Anne Marie Dryden & Hans Bischoff do not guarantee, represent or warrant that the information contained in this newsletter is accurate, complete, reliable, verified or error-free. This newsletter should not be taken or relied upon as providing legal, accounting or tax advice. You should obtain your own personal and independent professional advice, from your lawyer and/or accountant, to take into account your particular circumstances. Commissions, trailing commissions, management fees and expenses all may be associated with ETF & mutual fund investments. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any security holder that would have reduced returns. ETF’s & Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. Please read the prospectus before investing. The views expressed in this message are not necessarily the views of Investia Financial. Exchange traded funds, mutual funds and exempt market products are offered through Investia Financial Services Inc.